A couple of years ago, Monica Watrous (@MonicaWatrous) reported that the Specialty Food Association and Mintel International concluded millennials are driving the specialty food segment. According to their study, “Millennials … spend more money than older consumers on such products as high-end chocolate, olive oil and cheese.”[1] I’m always a bit skeptical when it comes to making sweeping claims about millennials (aka Generation Y). Millennials are normally classified as individuals born between 1980 and 2000 — making the oldest millennials around 36 and the youngest around 16. As millennials grow older, that age spread will make less of a difference; but, for now, I think the age spread is too large to rationally make generalizations about them. Teenagers and mature adults have very different perspectives on life and very different food preferences. If millennials truly are driving the specialty food segment, my suspicion is that older millennials are the people doing the buying. According to Watrous, “Specialty foods are defined as products of premium quality that may be made by small or local manufacturers, feature ethnic flavors, or contain the best available ingredients.” That doesn’t sound much like something with which millennial teenagers would concern themselves. Watrous provides a little more detail about the study:

“While baby boomers are more likely to buy gourmet items for everyday cooking, younger adults purchase specialty food for snacks and on-the-go meals. Women are more likely than men to buy specialty food products, and the segment’s core consumer is aged 18-44 with an income of $75,000 or more. Of those who buy specialty foods, 84% support companies that practice sustainability, 21% buy gluten-free products, and 17% purchase kosher or halal certified foods. Additionally, 24% of men and 33% of women who buy specialty foods look for products made without bioengineered ingredients. The top factor influencing a specialty food shopper’s purchasing decision is taste, but the opportunity to try something new, impulse or referral from family and friends also are important drivers.”

Although it may be too soon to make sweeping generalizations about millennials, I believe it is fair to say Generation Y taste preferences are likely to differ from previous generations. Since millennials now make up the largest segment of the work force and are becoming more affluent, retailers (including grocers) are taking notice. Kristen Cloud (@KCloudShelby) reports, “One of the largest generations in U.S. history is moving quickly into its prime spending years and forcing companies to re-evaluate the way they do business. Currently, the size of the U.S. Millennial market is 75.4 million, according to a Pew Research Center article entitled, ‘Millennials overtake Baby Boomers as America’s largest generation’. … There is no doubt that Millennials are creating their own path and challenging every business and institution.”[2] Phil Dance (@Phil_dance) reports another way millennials differ from older generations is how they shop for groceries. “The evolution of shopping apps proves to be the biggest growth trend with Millennials and their grocery shopping behaviors,” he writes. “According to data collected from our Shopper STAT study, which interviews 1,000 grocery shoppers each week, 43 percent of Millennials report using some kind of mobile app to grocery shop — either to help them prepare a list, search for coupons or check for store sales ahead of shopping. The growth of shopping apps is staggering and continues to be on an upward cycle.”[3] Dance also notes “there were several common characteristics among typical mobile app users,” including:

- A higher percentage of grocery app users are female compared to non-app users (78 percent vs. 73 percent).

- They are more likely to have at least a bachelor’s degree or higher compared to those who don’t use apps (38 percent vs. 31 percent).

- They are more likely to be in a committed relationship (either married or with a significant other) – 67 percent vs. 58 percent of non-app users.

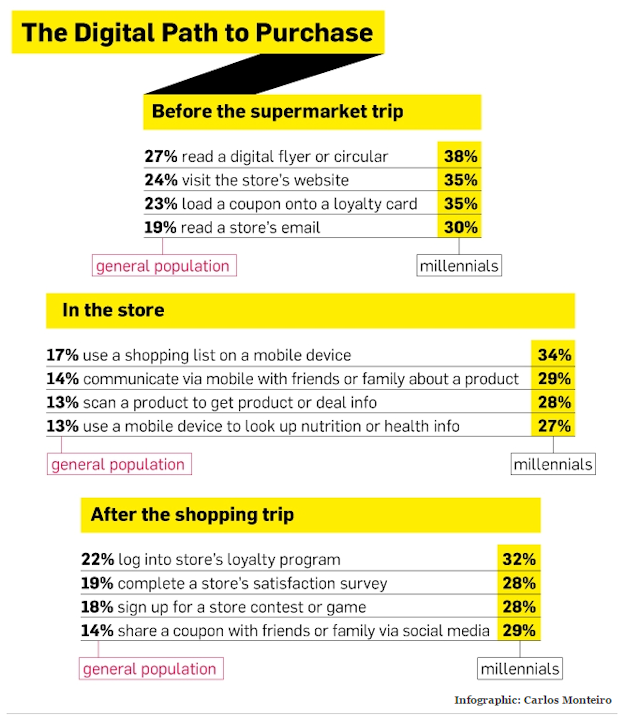

“In addition to these planning and saving apps,” Dance writes, “consumers are also turning to grocery delivery services such as Instacart, Amazon Fresh and others. These services have seen remarkable growth over the last two years and while some may question their ability to sustain growth and viability, it’s important to understand this shift.” An infographic published by Adweek provides more evidence that millennials use the digital path to purchase than older generations when they shop for groceries.

The fact that millennials use loyalty programs more than previous generations is good news for grocery retailers. Janet Forgrieve (@JFo360) reports stores that leverage data collected from loyalty programs fare better than those that don’t. She writes, “Grocery stores have been collecting data through loyalty programs for more than two decades, and those that use the information they gather to improve the shopping experience stand to boost same-store sales by 5% to 10%, according to a study done a few years ago by business analytics and intelligence provider SAS.”[4] Steve Banker (@steve_scm),Service Director for Supply Chain Management at ARC Advisory, agrees that loyalty programs and in-store apps offer tremendous opportunities for grocers and the brands they sell.[5] He explains:

“With a year’s worth of data, a retail chain should understand whether a shopper is on a budget and even calculate the spending limit of the budget. They can understand which shoppers are on a diet, either permanently or temporarily. Brand loyalty can be calculated. The combination of more targeted promotions and contextual inventory data offers intriguing possibilities. The result could be that for a smaller expenditure of money, a consumer good’s marketing department achieves their goals at a lower total supply chain cost. … Historically, promotions often caused real pain to the supply chain organization. Improved sales and operations planning processes has helped to fix that. Now better segmentation data creates the possibility of better demand planning at the store level; thus brand owners would be less likely to end up in excess inventory positions in the first place. Secondly, when excess inventory situations do arise, there will be better ways to rectify the situation. Recently, omni-channel has been all the rage. But for grocery chains and the brand owners that supply them, the demand driven supply chain for traditional in-store shopping may continue to offer the larger opportunity.”

Neil Z. Stern (@neilstern1), a senior partner of McMillanDoolittle, believes millennials could play a role in changing some business models. He reports a grocery store in Netherlands called Bilder & DeClerq has taken notice of the fact that millennials grocery shopping habits are different from previous generations. “Each day,” Stern writes, “the store offers 14 recipes, complete with all of the ingredients that one would need to prepare that recipe. And by all, we mean that each ingredient is available, portion controlled, so there is no waste.”[6] Stern calls the retailer a “meal solution store” and openly wonders whether these types of stores will grow. They sound like they may be right up the millennial alley. As millennials mature and preceding generations head into retirement, grocery shelves are likely to reflect Generation Y preferences. Brands would be wise to get in front of this trend and big data analytics can help them do just that.

Footnotes

[1] Monica Watrous, “Specialty foods strike millennials’ fancy,” Food Business News, 24 September 2016.

[2] Kristen Cloud, “Millennials Present New Challenges, Enormous Opportunity For The Meat Industry,” The Shelby Report, 17 August 2016.

[3] Phil Dance, “The Intersection of Technology Apps and Grocery Purchases,” Progressive Grocer, 22 April 2016.

[4] Janet Forgrieve, “Why big data is a big deal for supermarkets,” SmartBrief, 15 December 2014.

[5] Steve Banker, “In-store Shopping Apps and the New Grocery Supply Chain,” Logistics Viewpoints, 15 December 2014.

[6] Neil Z. Stern, “Are meal solution stores on their way?” Supermarket News, 13 October 2014.