One of the most prominent trends of the Digital Age is increased traffic on the digital path to purchase. As a result, some experts are wondering what effect this trend will have on the consumer packaged goods (CPG) sector. Robert J. Bowman, managing editor of SupplyChainDive, writes, “The big consumer packaged goods brands have ruled retail for a century or more, brushing off challenges from an endless stream of agile newcomers and the rise of big-box stores. But nothing has disrupted the world of old-line CPG as much as the coming of e-commerce, led by that behemoth known as Amazon.com.”[1] Bowman asserts “two big questions loom” over the CPG sector. They are: “How much of consumers’ altered spending behavior over the last year is permanent? And can brands adjust to this new normal, whatever shape it might take?” According to analysts from ABI Research, CPG brands are not going to relinquish their prominent position without a fight.

An ABI Research press release notes, “Manufacturers of consumer-packaged goods are utilizing analytics to anticipate customer demand and optimize their processes.”[2] The company’s research predicts the CPG sector will spend increased amounts of revenue on digital transformation efforts over the next decade. By 2030, the firm expects CPG digital transformation spending to approach US$24 billion. In the analytics area alone, CPG manufacturers are predicted to spend US$4 billion in 2030, up from US$500 million in 2021. ABI Research analysts conclude, “While retailers have been incorporating data into their decision-making for years, the manufacturers of the products they stock are now beginning to create digital threads.”

Brand Loyalty in the Digital Age

Even before the pandemic hit, younger consumers demonstrated less brand loyalty than older generations. Brand loyalty was also tested during the early panic-buying, pantry-stocking stage of the pandemic as shortages of some products forced consumers to try alternative brands and products. The Marketing Charts staff reports that, even though CPG spending increased, large CPG manufacturers lost market share. The staff writes, “Last year saw US CPG dollar sales rise by an astounding 10.4% over 2019, continuing the growth trend experienced since 2017, but far exceeding the growth rate seen in the past. This is according to a recent study from IRI and Boston Consulting Group (BCG) that also found that private label, small and extra small companies were drivers of growth, while larger companies are seeing their market share continue to decline.”[3] Data like that motivated journalist Joe Mandese (@mp_joemandese) to ask, “Has COVID-19 changed brand loyalty?”[4]

According to Mandese, the story is mixed. He explains, “The good news is nearly nine out of ten Americans say they are loyal to at least a few brands a year after the COVID-19 pandemic. The bad news is we don’t really know how their loyalty has changed because of it.” Those conclusions were drawn from a survey conducted by GfK earlier this year. Another factor affecting CPG brand loyalty has been the rise of direct-to-consumer (DTC) brands. Manas Agrawal (@manas_affine), CEO of Affine, explains, “An interesting thing happened to consumers during the COVID-19-induced lockdown. Their favorite CPG brands disappeared from their pantry shelves. Reliant, now more than ever, on new channels instead of brick-and-mortar stores, the pantry-owner discovered DTC brands. With convenience and personalized experience, DTC brands made their way to household pantries across the world.”[5] He asserts, “This trend will only get sharper with more and more customers renouncing the commonplace CPG labels in favor of their new, lesser-known DTC variants unless the CPG companies kickstart their journey of transformation right away.”

Agrawal believes the best hope for CPG brands to retain consumer loyalty is by leveraging data. He explains, “The new-age consumer is researching, inquiring, shopping, and otherwise engaging with CPG brands online, producing brand new data sets every minute. Brands can tap into this rich, massive trove of information to precisely decipher the consumer journey, and design and deliver distinctive experiences that appeal to the unique demands of the customers.” At the same time, brands must understand a growing consumer reluctance to share personal data online. The news on that front is not all bad. Mandese reports, “The [GfK] research found that 36% of Americans say they are more likely to trust brands with their personal data vs. how they felt before the pandemic. Only 15% said their level of trust dropped, indicating that roughly half of Americans haven’t really changed how they view how brands handle their data.” Nevertheless, failure to protect personal consumer data is a surefire way to lose customer loyalty.

In an interesting twist, Bowman reports, “Against expectations, many brands have upped their traditional advertising budgets significantly over the past year. Faced with the prospect of eroding customer loyalty, they’re determined not to fade away on any platform, whether that be the brick-and-mortar store or cutthroat world of online shopping.”

Future CPG Success Relies on Data

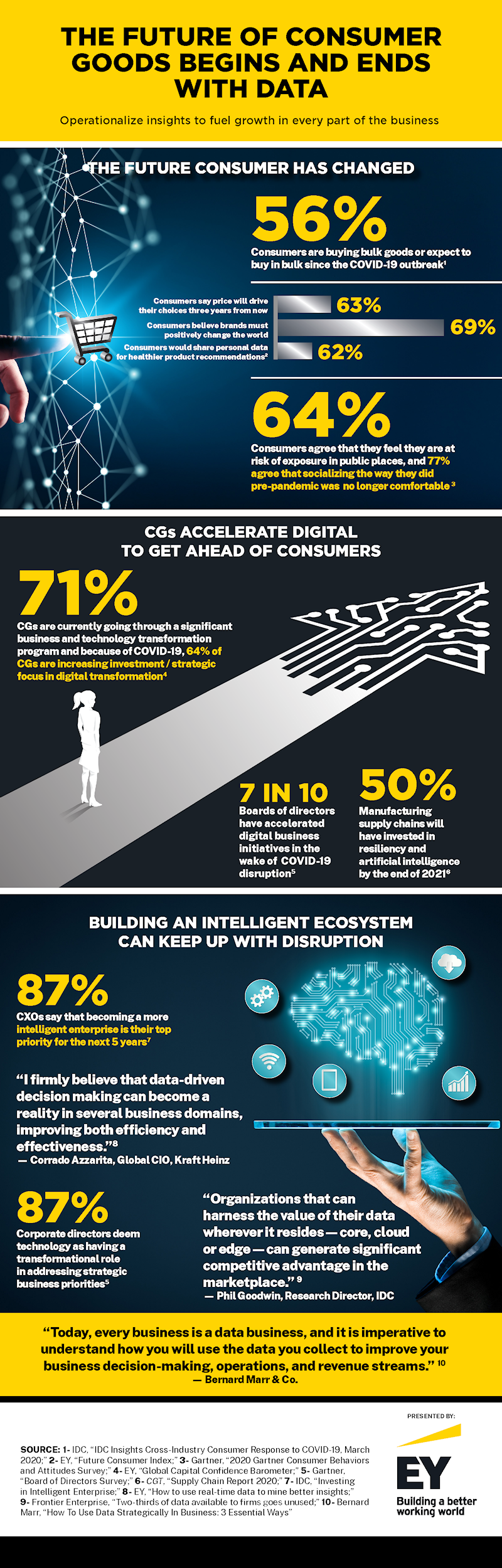

In the future, ABI Research analysts conclude, “Digital threads will be essential for CPG manufacturers to meet the needs of their various stakeholders.” Michael Larner, Industrial and Manufacturing Principal Analyst at ABI Research, explains how those digital threads will be used. He states, “Manufacturers need work with retailers and supply-chain operators to, among other things, anticipate and prepare for demand surges, have flexibility on their production lines to accommodate trial flavors and new packaging as well as have the required documentation available for regulators as evidence of how the facility handles ingredients.” Larner’s examples highlight the number of different types of data CPG manufacturers require as well as the various types of analysis that needs to be accomplished. Analysts from the consulting group EY insist “the future of consumer goods begins and ends with data” and they prepared the following infographic to make their point.

Deren Baker (@deren_baker), CEO of Edge by Ascential, observes, “Today, four of the top five global retailers in the world are ecommerce-first businesses: Alibaba Group, Amazon, Pinduoduo and JD.com. The leading legacy store-based retail leaders around the world are urgently and heavily investing in digital technologies, like automation and AI, at the shopper-facing end of the value chain as well as the product-delivery end. They know they must act swiftly to catch-up with the ‘born-digitals’ and adapt their business models to capture future ecommerce growth, set to substantially outperform any store-based channel over the next few years.”[6]

Concluding Thoughts

Agrawal concludes, “Brands that are founts of intelligent strategy, customer convenience, personalized consumer experience, operational nimbleness, and speedy execution are the only ones that will survive in the long run. … It is a new world for CPG brands and their customers. And the ability to choose the right data and analytics engine will set the winners apart.” As the CEO of cognitive computing firm focused on the CPG sector, I couldn’t agree more. The Enterra Global Insights and Optimization System™ is designed to help CPG firms thrive in post-Covid world. Baker concludes, “The global pandemic has shifted the way in which consumers shop and brands need to act accordingly. With marketplaces set to dominate in the new era of retail, it is essential that brands do not ignore their presence and spending power. Savvy brands looking to get ahead should therefore adapt their strategies to these platforms if they want to reach consumers and grow — if you can’t beat ‘em, join ‘em.” At the very least, brands needs to master omnichannel operations, which will make them more agile and resilient in the years ahead.

Footnotes

[1] Robert J. Bowman, “Does the ‘New Normal’ of Retailing Mean the Death of CPG Brands?” SupplyChainBrain, 24 May 2021.

[2] Staff, “Manufacturers of Consumer-Packaged Goods to spend US$23.8 billion on Digital Transformation by 2030,” ABI Research, 15 June 2021.

[3] Staff, “Large CPG Manufacturers Continue to Cede Market Share,” Marketing Charts, 25 March 2021.

[4] Joe Mandese, “Has COVID-19 Changed Brand Loyalty?” MediaPost, 12 April 2021.

[5] Manas Agrawal, “How CPG brands can retain consumer loyalty through data analytics,” YourStory, 4 May 2021.

[6] Deren Baker, “In the digital future, CPGs must have a marketplace strategy to succeed,” Internet Retailing, 21 May 2021.