I suspect that many (if not most) readers of this blog know that supply chain analyst Lora Cecere has started a new company called Supply Chain Insights. One of the first reports that her new company published is entitled Building Market-driven Value Networks. Cecere has been a long-time advocate of demand driven supply chains, which she believes must be designed from the outside in rather than the inside out. The same is true with market-driven value networks, but she believes such networks represent the next step beyond demand driven supply chains. In her report, Cecere writes:

“Market-to-market pressures and volatility have never been higher, yet companies have not redesigned their supply chain processes to absorb the impacts and improve resiliency. We believe that it is time to change supply chain processes.”

Cecere indicates that her vision of a market-driven value network is “largely aspirational.” Nevertheless she feels that it is important to discuss the concepts required to make it a reality. Here is how she defines a market-driven value network:

“Market-driven value networks are adaptive supply chains that can quickly align organizations market-to-market to focus on the delivery of a value-based outcome. They sense and translate market changes (buy- and sell-side markets) bidirectionally with near real-time data latency to better optimize and align sell, deliver, make and sourcing operations to the goal. The focus is on horizontal process orchestration.”

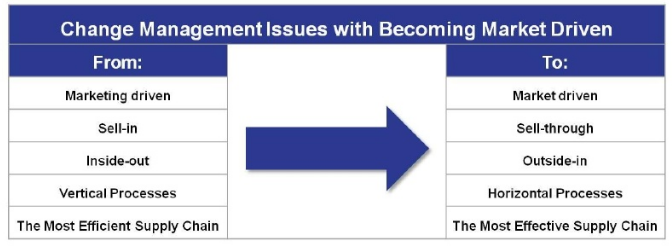

Cecere notes that the traditional definition of a supply chain (namely, “the right product at the right place at the right time”) is too antiquated to meet the challenges of today’s business environment. Today’s supply chains are so large, so geographically dispersed, and so complicated that simple solutions are no longer possible. That is why Cecere believes that value networks must sense and respond in near real-time. The other thing that Cecere’s definition implies is that traditional corporate silos must be broken down. Business silos create caches of information that often go unshared and, therefore, contribute little to corporate alignment. Business silos also represent barriers to rather than gateways for horizontal process orchestration. Cecere is a big believer in sales and operations planning (S&OP) and business silos have proven detrimental to achieving the kind of planning objectives that she believes are possible. Cecere doesn’t pretend that redesigning and implementing new value network processes is going to be easy. The chart below, taken from the report, shows some of the issues she indicates are involved.

The reason that Cecere has started talking about market-driven value networks instead of demand-driven supply chains is because she insists, “It cannot be JUST about demand.” She goes on to note that “supply has grown in importance for all.” As a result of today’s “more complicated environment,” she writes, “the supply chain plays a higher profile role in the organization.” The supply chain’s profile has risen because it is “fraught with both more risk and opportunity.” The ultimate goal of a market-driven value network is to decrease risks while taking advantage of opportunities. Cecere insists that as companies try to navigate the ever-changing business landscape, they are coming to realize that excellence in the supply chain is critical. She asserts that the processes required to successfully traverse this complex and volatile landscape are: “1) horizontal, 2) outside-in and 3) agile.”

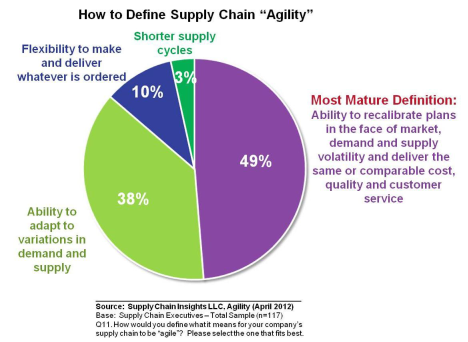

Cecere writes, “Ask any supply chain leader if they want to be more agile, and they will all give a resounding ‘Yes!’ But, if you ask them what they mean by ‘agile,’ you will get a range of responses.” To demonstrate her point, Cecere included the following graphic.

Commenting on Cecere’s report, Trevor Miles indicates that he likes the “Most Mature Definition.” He believes that “Agility … is a key outcome” of market-driven value chains, “the others being Visibility and Alignment.” Speaking of alignment, Miles highlighted the example of Cargill Beef that Cecere mentions in her report:

“Cargill Beef is a market-driven leader. The Company uses price optimization tools to evaluate the market potential for beef. Before the company decides what to package for the market, they first evaluate the market potential for each cut of beef and then optimize how they harvest their inbound herds to maximize the opportunity and minimize the risk. There are 197 ways to cut up beef cattle. Since each breed of cow has a different potential or finite mix of products—steaks, ground beef, roast, etc.—Cargill uses the technology in Sales and Operations Planning to drive rancher insights to define which breeds are best for customer demand. This process of being adaptable to trade-offs from market-to-market based on the use of optimization technologies is termed demand.”

Concerning this example, Miles writes:

“This is a great example of Alignment across the supply chain. As always I am not thrilled by the term ‘optimization technologies’, and I am sure we could convince Lora that demand prioritization and smart heuristics could provide answers that are close enough. More important is the description of how the end-to-end supply network is aligned around market drivers. If you think of the lead time from calf to cow, changing a farmer’s breed mix has a significant lead time, and market needs will change in this time.”

Of the three key outcomes identified by Miles (i.e., Agility, Alignment, and Visibility), Cecere indicates that achieving visibility is probably the long pole in the tent. She writes:

“Despite three decades of investment in supply chain planning, in a recent research survey of forty supply chain leaders, only 8% of companies surveyed felt that they have the Business Intelligence (BI) capabilities to adequately analyze demand and supply trade-offs through what-if analysis in this new and challenging environment.”

Adding his views to Cecere’s, Miles writes that he likes “Lora’s use of the term Sensing in the report to denote a higher order Visibility.” He continues:

“My take is that Visibility is knowing not only where stuff is, but also the business outcomes that result. I agree that lots of people are looking for the physical visibility as a starting point. Hence the difficulty of coming up with the right term because I wanted to capture the ‘know-where-my-stuff-is’ visibility, but not lose the ‘what-does-it-mean’ visibility. Sensing is ‘what-does-it-mean’ visibility, but Sensing is an action, not an outcome.”

Cecere believes that “today’s supply chain is strong in the middle,” but, “the ends are fragile.” In the past, she has discussed the requirement to know what is happening at a supplier’s supplier as well as what is being demanded by a customer’s customer. Those are the fragile ends. To strengthen the fragile ends, Cecere asserts that supply chains must mature into market-driven value networks. To make her point, she quickly takes readers through a historical journey of supply chain development. She believes there are have been (or are going to be) five stages of development: 1) The Efficient Supply Chain; 2) The Reliable Supply Chain; 3) The Resilient Supply Chain; 4) The Demand-driven Supply Chain; and 5) Market-driven Value Networks. She concludes:

“The market-driven supply chain is a future state aspiration for the supply chain leader. The concepts are based on building advanced processes to listen, test and learn. This will happen through the application of Big Data concepts … and new forms of predictive analytics. The design of market-driven supply chains is dependent on an end-to-end vision. It is contingent on the effective building of value networks, strong horizontal processes, the redesign of supply chain processes and a retraining of the organization.”

I’m glad that Cecere eventually got to the matter of people (i.e., the retraining of the organization). No redesign will be successful if it doesn’t include people, process, and technology. They all must be aligned if the organization is going to be focused on the right things and headed in the right direction. I’m also pleased that Cecere believes that my company, Enterra Solutions, is going to help businesses achieve her vision of implementing market-driven value networks. In a recent post, she wrote:

“For me, the most exciting news is coming from the Best-of-Breed Providers. I am bullish about the opportunities for E2Open, Enterra Solutions, Llamasoft, Kinaxis, ModelN, Predictix, Red Prairie, Signal Demand, Steelwedge, Terra Technology, and SmartOps to bring industry-specific solutions with greater depth to the market. They will push the envelope on the delivery of industry-specific SaaS solutions. They will do it faster with support from their clients.” [“Which Boat do You Sail to Cross the Blue Ocean? Supply Chain Shaman, 6 August 2012]

Cecere’s report has a lot of other useful information in it and I highly recommend that you download and read it.