Bill McBeath, from ChainLink Research, asserts, “For many industries and companies, merely managing their own immediate suppliers is no longer sufficient. Someone has to step in and coordinate key activities across the supply chain.” [“2011 Supply Chain Orchestration: Part One,” 1 February 2011] McBeath labels companies that “are managing multiple tiers of their supply chain … Supply Chain Orchestrators.” These orchestrators manage “their suppliers’ suppliers and further upstream suppliers” in an effort “to ensure supply continuity, social compliance, and to gain competitive advantage.” McBeath continues:

“These Supply Chain Orchestrators tend to be brand owners whose reputation and competitiveness are on the line based on the performance and actions of the whole chain. They are the ones who have the power to influence and direct the whole chain.”

McBeath’s last point is important. Not every company has enough “power” that it can “influence and direct the whole chain.” Simple logic informs us that an orchestra can only follow one conductor at a time and that the supply chains can only be orchestrated by one dominant stakeholder at a time. McBeath points out that “multi-tier relationships can take different forms.” He describes a few:

- “Selecting Suppliers Across Multiple Tiers (‘Configuring the Chain’)—In some cases, the quality of a particular component or assembly is so critical, that the OEM not only selects their immediate tier 1 supplier, but also actively influences or actually selects tier 2, 3, or 4 suppliers for specific very critical materials and components. In addition, we are seeing more ‘project-based supply chains,’ especially in apparel, where an OEM creates a concept for the next fashion season then proceeds to select all of the players in the chain to deliver that concept; all the way back to selecting the right farms growing exactly the right cotton they need for this shirt, the mills that are best at weaving that type of cotton, and the cutter that is best with that cloth, etc. Logistics costs and location become part of the decision making process as well. Often these supply chains are assembled on a project-by-project basis.

- “Buying on Behalf of Multiple Tiers—This is where an OEM buys materials for one or more of their suppliers. In some cases, an OEM is buying on behalf of one or more of its contract manufacturers either because the OEM has better purchasing and negotiating power, or because they want to ensure continuity of supply, or want to ensure transparency of pricing (i.e. avoid excessive markups by their contract manufacturer) or a combination of these factors. A rather different variation is where an OEM buys a specific material (e.g. steel) for their entire supply chain. In this case the aggregate multi-tier material requirements (not just for their own manufacturing operations, but also for their suppliers and whole chain) flows through a purchasing platform run by the OEM. This allows much stronger purchasing power than is possible by each small shop in the chain, and allows for consolidation of material specifications. This approach has been adopted in certain sectors (e.g. automotive).

- “Education and Process Improvements Across Tiers—Some companies invest in strategic relationships not only with key direct suppliers, but in some cases with a few critical tier 2 or 3 suppliers, helping those suppliers learn about and implement process improvements such as 6-sigma or lean initiatives.

- “Compliance Programs and Audits—Increasingly, brand owners and retailers are being held responsible for what happens throughout their supply chain, either by law or by the court of public opinion. This compels them to take a much more active role in making sure all the players throughout their supply chain are acting responsibly. It is much harder now for the brand owner to get away with saying ‘I didn’t know’ or ‘that’s not my factory, not my responsibility.

- “Multi-Tier Supply Chain Risk Management—Many companies have some form of risk management program with their immediate suppliers to keep tabs on risks related to supplier financial viability, weather and geopolitical risks, sole sourcing risks, etc. Some OEMs have learned the hard way that they also need to pay attention to risks and constraints further upstream in their supply chain. A disruption at the supplier’s supplier can have a severe impact. The fact that some of these disruptions also affect a company’s competitors does not diminish the importance of managing these risks, as one firm may gain a large competitive advantage if they manage those risks better than the competition.”

In the second installment of his series on supply chain orchestration, McBeath discusses the second type of multi-tier relationship discussed above — “Buying on Behalf of Multiple Tiers.” He concludes:

“Buying across multiple tiers consolidates spend[ing], allows better optimization of inventory and transportation, reduces payment for credit risk, and exposes how efficient each supplier is at the value add processing.”

In the third installment of this series, McBeath describes how Ford Motor Company attempts “to get vertical integration benefits from a multi-tier supply chain – specifically, how they buy steel on behalf of their entire supply chain.” In the final installment, he continues his discussion about Ford’s supply chain and discusses how the company is able to use its “multi-tier platform to rationalize the specifications for the steel that is bought across [its] supply chain, and how that helps [it] to consolidate spend[ing], make better use of inventory, and provide more flexibility.” He concludes:

“Today, Ford directs more than $4 billion of steel annually across a network of 1,000+ users from 400+ entities, operating out of 500+ locations. [It] collaborate[s] with [its] suppliers to manage over 100,000 parts, materials, and part-to-material relationships. The investment, process changes, and effort required to run this vast multi-tier procurement network has been substantial, but well worth the payback. Most companies do not play the dominant ‘anchor tenant’ role in their supply chain. But for large OEMs or key players in a supply chain, especially in industries with large volumes of commodities spend spread out across multiple tiers, a networked multi-tier procurement approach can have enormous benefits.”

Jane Barrett, Managing Vice President at Gartner, says that supply chain orchestrators sit at the top (Stage 4) of “Gartner’s four-stage maturity model.” [“The Secret Sauce to Supply Chain Orchestration,” Supply Chain Brain, 11 May 2011] She claims that not many companies can be called orchestrators. “In fact,” she writes, “what we see most often is pockets of Stage 4 excellence.” She continues:

“Let’s delve into this term ‘orchestration’ and see what it really means in [the] supply chain. According to dictionary.com, ‘orchestrate’ means ‘to arrange or manipulate, especially by means of clever or thorough planning or maneuvering.’ Freedictionary.com defines it as ‘[arranging or controlling] the elements of, as to achieve a desired overall effect.’ Synonyms include organize, coordinate, facilitate, plan, mastermind, harmonize, symphonize, integrate, compose, balance and unity. However, most companies are still in Stage 2, and the realization of these characteristics is still only aspirational.”

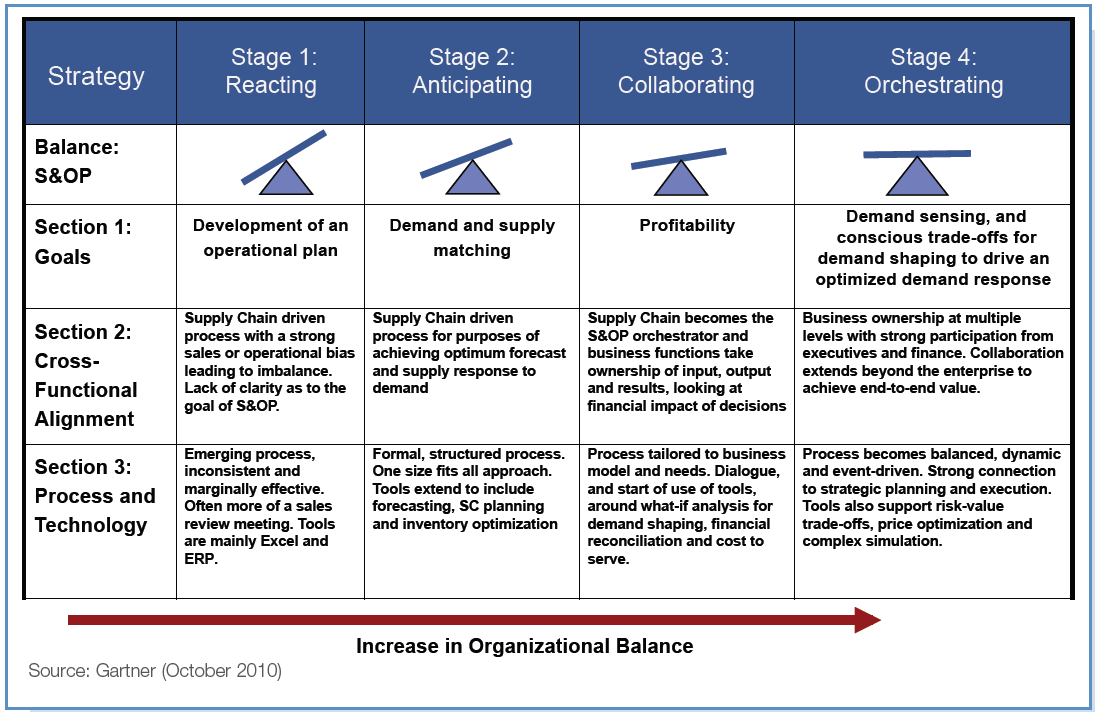

For those unfamiliar with Gartner’s Maturity Model, the below figure provides a good explanation of the four stages.

Barrett notes that Stage 4 “orchestration describes a value-driven organization that is consciously excellent.” This excellence is derived “from advanced capabilities in information management, demand sensing and shaping, cost-to-serve analysis, end-to-end segmentation, simulation and analytics. It requires strong collaboration internally and externally.” In other words, you can’t leapfrog Stage 3 (Collaboration) into Stage 4 (Orchestration). Collaboration precedes orchestration. To read more about supply chain collaboration, see my posts entitled Supply Chain Collaboration and IBM’s Top Five Supply Chain Challenges. Barrett continues:

“Every successful company has multiple projects on the go to achieve these capabilities, but most can’t get out of Stage 2. So, what’s the secret sauce for the leaders? What do the best in our Supply Chain Top 25 ranking do to keep them there year after year? It may sound like ‘same old, same old,’ but the success of moving up the maturity curve and sustaining those capabilities boils down to these three factors:

• Having the right organizational design and talent

• Having the right culture and governance that manages change

• Having the capability to continuously enhance processes and the enabling technology to support good decision making, or what we call becoming consciously excellent”

If you are curious as to who made Gartner’s Supply Chain Top 25, here’s the list: 1) Apple; 2) Procter & Gamble; 3) Cisco Systems; 4) Wal-Mart Stores; 5) Dell; 6) Pepsico; 7) Samsung; 8) IBM; 9) Research in Motion; 10) Amazon.com; 11) McDonald’s; 12) Microsoft; 13) The Coca-Cola Company; 14) Johnson & Johnson; 15) Hewlett-Packard; 16) Nike; 17) Colgate-Palmolive; 18) Intel; 19) Nokia; 20) Tesco; 21) Unilever; 22) Lockheed Martin; 23) Inditex; 24) Best Buy; 25) Schlumberger. Barrett insists, “Investing in a culture that embraces change is paramount when creating a supply chain organization that can orchestrate and is resilient.” She then provides a list of things that “the best continuously do”:

“• Embrace outside-in thinking, and learn from those that have cultures that constantly challenge, question and push the envelope of the status quo embedded in their DNA. These companies invest in people focused solely on this — on centers of excellence (COEs) or strategy groups. These people don’t have other ‘day jobs.’ …

“• Invest in training and supply chain capabilities, continuously raising the bar on talent, process integration and technology enablement. Change backed by clear strategy that’s backed by deep analysis is easier to drive. …

“• Empowerment is key. Consider this seemingly simple but hugely impactful change: A very successful distributor had strict rules, which are typical in its industry, for changing inventory policies. However, when the recession hit in 2009, this cumbersome process created a bottleneck. The distributor empowered lower levels to make quick decisions on inventory, which served it well through the downturn and when the economy picked up.

“• Define the vision, and give people stretch goals to help them get there. The vision must look beyond the norm, embrace out-of-the-box thinking and rewrite the rules of traditional best practices, if needed. It must be enabled by a well-defined burning platform, compelling vision and a road map. However, organizations must have the capacity to change — vision without the capacity and a road map is signing people up for frustration and burnout.”

Although each of those corporate characteristics is important, many top supply chain analysts believe that the first characteristic (i.e., embracing outside-in thinking) is the key to achieving Stage 4 orchestration. Barrett provides “two final thoughts — the first for companies in Stage 1 or Stage 2 that are still focused on supply chain excellence, and the next for the more mature.” Here is her recommendation for Stage 1 or 2 companies:

“If your focus is still just supply chain, that’s a problem. You need an executive-led, value chain transformation program in place to break out of those inward-looking shackles and start driving value. Value is joint value and outcome-driven — consider profitable perfect orders for trading partners versus the traditional on-time, in-full delivery metric.”

To underscore the need for companies to expand their vision beyond the supply chain, Gartner analysts refer to the end-state as Demand-Driven Value Networks. I believe the term “supply chain” is too ingrained our business culture to be easily displaced, but Barrett’s point is a good one. In a previous post, I argued that supply chain professionals need to have seat at the table in the highest levels of corporate decision-making. I think that is what Barrett means when she asserts that companies need “an executive-led, value chain transformation program.” Finally, below is her recommendation for “more mature” companies:

“For the leaders mastering value chain transformation, what’s beyond orchestration? If orchestration implies the coordination, harmonization and arrangement by the mastermind — the orchestrator of the enterprise — then surely what comes next in our intricate global environment is the need to do this across multiple networks and enterprises in a way that’s overlapping, but synchronized. So, for those of you who have Stage 4/orchestrate capabilities or vision, is choreography the next level of capability to which you should aspire? Do your planning capabilities really allow you to choreograph your global network?”

I believe Barrett is talking about what IBM’s Sam Palmisano calls a “globally integrated enterprise.” For more on that subject, read my posts entitled Globalization and Resilient Enterprises, IBM’s Globally Integrated Enterprise, and More on Globally Integrated Enterprises. If maturing to Stage 3 (collaboration) and Stage 4 (orchestration) was easy, there wouldn’t be so many companies stuck in Stages 1 and 2. Barrett implies that in order to cross the divide companies must transform rather than evolve. For me, transformation implies a more difficult and rapid change than evolution. Supply chain analysts are well aware of the pain that transformation can cause companies; but, they obviously believe in the old sports axiom “no pain, no gain.”