Bob Ferrari notes that the ups and downs associated with recovery from the current recession “provide a reinforced reminder to the overall importance of active demand sensing and sales and operations planning processes” [“Uncertainty of Supply and Demand- Another Reminder on the Importance of What-if Planning Capabilities Within S&OP,” Supply Chain Matters, 7 July 2010]. He goes on to write, “Now more than ever, S&OP [Sales & Operations Planning] teams will need to be very diligent in noting any significant changes in demand or supply, and plan accordingly.” Not only do S&OP teams need to become proficient at forecasting, they need to work with company executives to plan for the unexpected — as Metropolitan Life puts it: the “what ifs” in life. Ferrari notes that during a recent web seminar involving S&OP practitioners “only 12% indicated that they felt that their organization had adequate what-if capabilities, and over 40% stated their company is only just starting to use what-if capability within the S&OP process.” What that tells me is that despite all the talk about demand driven supply chains, most companies have a long way to go to make them resilient.

Atul Chandra Pandey, an executive with Infosys Technologies, agrees with Ferrari that many companies need to reinvigorate their S&OP processes [“Visibility, Analysis and Control: Reinvigorate S&OP for Competitive Advantage,” Supply Chain Digest, 11 March 2010]. He writes:

“The discipline of Sales & Operations Planning (S&OP) has been around for a few decades now and industries have explored innovative ways to improve their demand and supply orchestration processes. However, many of them must grapple with discrepancies between the lauded potential and actual benefits of S&OP when they are unable to attain desired levels of synchronization in their supply chains. The recent economic downturn has highlighted the need for a robust and agile S&OP capability that ensures a sustainable competitive advantage. … Interest in S&OP has been rekindled as companies engage in rapid demand and supply synchronization at the operational and executive levels and create new growth opportunities.”

Pandey explains that despite recent advances in the tools available to S&OP teams, several challenges remain. He continues:

“To actualize its potential and realize true business benefits, S&OP needs to overcome some key challenges as listed below:

- Shorter Reaction Cycle: The reaction cycle i.e., time for companies to adjust to sudden changes in the market, is continuously getting shorter. This challenge is especially acute in the high-tech and consumer electronics sectors, where overall inventory levels need to be planned in a single instance. Reduced differentiation in these sectors and constant new product introductions further accentuate this problem. In several cases the planning and execution boundaries are beginning to blur.

- Multiple Consumer Data Streams: Social media has fuelled an explosion in consumer data streams such as consumer reviews, competitive intelligence and similar product launches. These sources are abundant and easily accessible to companies. The challenge lies in the speed and sophistication with which companies can assimilate this information into the short S&OP cycle and use it to drive actions in the exec S&OP meeting.

- Choosing the Right Demand Measure/ Lever: Companies must use the data gathered and analysis performed in the initial S&OP steps to determine further action. They can no longer depend solely on forecast as an adequate demand measure to influence revenue. Customer feedback, customer service, competitive intelligence, pricing, and supply constraints all serve as levers that need to be looked at simultaneously to shape profitable demand. This requires a comprehensive understanding of the competitive strategy and a clear connection between the correct operational metric and the associated overall goal.”

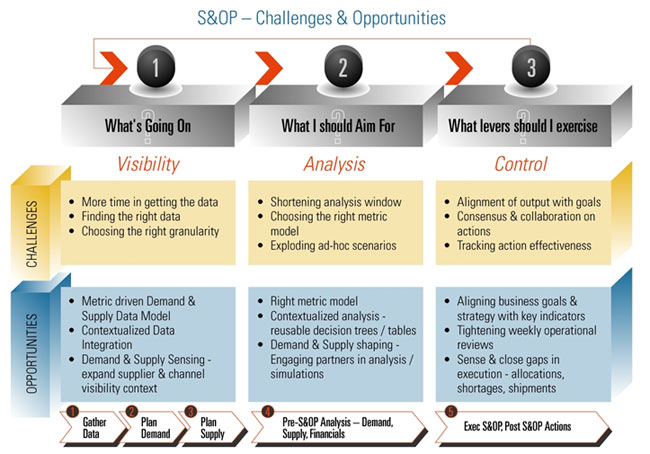

Normally, challenges and opportunities are bedfellows. Pandey indicates this is true in the area of S&OP as well. He includes the following graphic in his article to show some challenges and opportunities associated with S&OP.

Even if a company has the world’s best S&OP team, if planning results aren’t integrated with day-to-day operations in a meaningful way, planning adds little value to an organization’s bottom line. Greg Brady, founder, CEO, and Head of Research and Development at One Network Enterprises, asserts that “most organizations are not planning and executing across functional domains to create a truly interconnected and collaborative supply chain” [“A Missed Opportunity: Linking Demand with Transportation Planning and Execution,” Logistics Viewpoints, 2 March 2010]. He continues:

“While companies are effectively optimizing [demand planning, transportation planning, and execution] independently, they are rarely considering them together to better match supply with demand. … This disconnection translates into missed opportunities. This disconnect stems, in part, from technologies that are not integrated and don’t operate in real time. Planning applications that run in batch are separate from execution systems. The information that was used to create the plan is typically 18 or more hours old, and by the time the plan is executed, the landscape has inevitably changed. Supply chains operate in real time, and technology is not keeping up.”

Brady goes on to provide some recommendations about how an organization can overcome its disconnection challenges. He concludes:

“Companies that have successfully tied demand to their transportation planning and execution processes have been rewarded with reduced stock outs, increased sales (especially during promotional periods), along with decreased inventory. Additionally, they have reduced overhead costs by eliminating inefficient manual processes attributed to information breakdowns within and across the supply chain.”

Aatish Goel believes that demand driven supply chains are placing enormous stresses on planners [“Are Demand Planners stressed out these days?” Supply Chain Management, 2 March 2010]. The only way to ease this stress, he asserts, is “to look for more innovative ways to accomplish all the activities.” Being able to sense demand trends early is perhaps the most important thing they can do. Supply chain analyst Lora Cecere insists that market leaders sense shifts in demand five times faster than run-of-the-mill organizations [“Good Forecasting Matters,” Supply Chain Shaman, 5 April 2010]. As a result, she indicates, market leaders have done much better during this recession. Unlike Brady, however, Cecere doesn’t think it was technology that made the difference. She writes:

“The interesting fact for me was the capability to sense and translate demand had less to do with technology adoption – the type of system and how it was installed – than attitude and capabilities. Leaders had the right stuff. They did three things differently:

Forecast was True North: Over 80% of companies have implemented supply chain forecasting systems; but, very few have a signal that is true north. True north is a forward-looking compass set on true market demand. Companies with inherent forecast bias were challenged; and companies dependent on sales forecasts were crippled. The companies that did the best were outward-focused using true market indicators and modeling what-if scenarios based on market drivers. Forecast models based on orders and shipments were simply not equal to the task.

Outside-in Focus: Companies that modeled ship-to locations based on selling units out performed. For most this was too HIGH of a bar. Why? Over 80% of forecasting systems are built with tight integration to ERP using ship-from locations (distribution warehouses) as opposed to ship-to (channel locations); and modeling is based on the manufacturing unit, which can be VERY different than the selling unit. Likewise, companies that out-performed had replaced rules-based consumption in Distribution Requirements Planning (DRP) with daily statistical modeling using channel demand to calculate required inventories.

Forecast Discipline: The companies that did it well were good at forecasting. They had process discipline: few managerial overrides and when overrides occurred, they held people accountable for bias and accuracy. These companies had experienced forecasters behind the wheel (as opposed to the new kid just hired from a MBA program), their forecasters knew their products and the market, and they excelled in what if analysis and the ability to use modeling programs.”

Cecere’s bottom line is that “forecasting matters.” She also believes, however, that good forecasting and a demand drive supply chain is not good enough [“Demand Driven is Not Sufficient,” Supply Chain Shaman, 18 June 2010]. She writes:

“I do not believe that Demand Driven is the end state. I believe that it is the most effective means to an end. … The research supports that demand-driven value chains based on outside-in design enables the most effective response with the least amount of waste. However, it is not sufficient. The market is upping the ante. The right product, right time, right place is not sufficient. The move is to value-based outcomes with demand-driven as a means to an end.”

Cecere provides examples of trends she sees occurring in the supply chain arena and concludes that four major shifts are underway. She writes:

“-The search is on to determine what drives maximum value. I am continually amazed that companies are not clear on what drives value in their value network. What are the right trade-offs? How do you maximize the response to trade off sustainability, corporate social responsibility, tax effectiveness, innovation/growth and risk? This search–especially sustainability and tax efficiency– are increasing the demand for network design analysis.

-Supply chain services have never been more important: In 80% of durable companies, services operate as a separate, and distinct profit center. This is a barrier to combining products and services to deliver value-based outcomes. The design and delivery of services need to be inter-woven through new product launch, Sales and Operations Planning, Network Design, and Third-party relationships (contract manufacturing and sourcing). The voice of the customer and warranty information needs to tie to product design, manufacturing, and sourcing decisions.

-Greater need to design the supply chain based on value-based outcomes from the outside-in: This trend ups the ante to design supply chains from the outside-in with a focus on the true customer and the design of the channel for effective delivery. The focus is sensing and real-time test and learn strategies.

-Data grows in importance. With these shifts, data grows in importance. Companies are increasingly learning the importance of master data management the HARD WAY! Today, we are seeing the rise in system deployments for planning master data, demand data and supply data. Strong horizontal processes require clean data held at the granular level to support what-if simulation. The good news is that we are seeing a redefinition of predictive analytics to support this change. For the first time, I am also seeing a new role: Vice President of Master Data Management.”

There are some common threads running through all of these supply chain gurus’ observations. First, good data is the sine qua non of a demand driven supply chain. In today’s fast-paced marketplace, that data must also be fresh (the closer to real-time the better). Second, good forecasting helps the bottom line by mitigating the ill effects of market volatility — especially during economic hard times. Finally, “what if” planning is essential. One cannot plan for the future simply by extrapolating from the past. The future has a funny way of jumping sideways and surprising us with twists and turns. A good what-if planning regime can help a company survive the unexpected.