At the moment, supply chain professionals have a lot on their plate — not the least of which is trying to avoid the worst consequences of the dreaded bullwhip effect. Three professors from the University of Tennessee, Ted Stank, Tom Goldsby (@ThomasGoldsby), and Lance Saunders, warned back in June 2021 that the bullwhip effect was already in play. They wrote, “Even though global supply chains are regaining their footing as the Covid-19 pandemic begins to ease in much of the industrialized world, recent data suggests that many businesses are about to be knocked off their feet again. Uncertainty surrounding the demand predictions needed to drive supply-chain decisions-making increased markedly during the past 15 months as the ripple effects of the pandemic disrupted traditional supply-and-demand patterns around the world.”[1]

Stank and his colleagues report the first signs of the bullwhip effect began when consumers, restless with “pent-up demand, the dissemination of pandemic relief checks and vaccinations,” began “spending, triggering shortages of many products that were overabundant a year ago. with reported shortages of semiconductors followed by shortages of other goods.” In other words, the whip had started to crack.

What is the Bullwhip Effect?

If you are unfamiliar with the bullwhip effect, I suggest watching the following short video. If you don’t have time to watch the video, Stank and his colleagues describe the effect this way:

“The bullwhip effect is a business phenomenon first described in the early 1960s by Jay Forrester at the Massachusetts Institute of Technology and more recently explored by researchers at Stanford University. The principle describes how companies typically respond to a spike in demand by ordering more products than required to hedge against potential continued growing demand and to avoid stockouts. This demand distortion is then passed along and amplified at each stage of the supply chain, with orders to suppliers furthest away from the point of sale far removed from the realistic views of consumer demand. The phenomenon can lead to the rapid expansion of manufacturing capacity, including accelerated procurement of supplies, labor, warehouse space and transportation for finished goods, often at a cost premium. Many of these same operating and distribution cost increases will be passed on to buyers in the supply chain, and ultimately to consumers at the point of sale.”

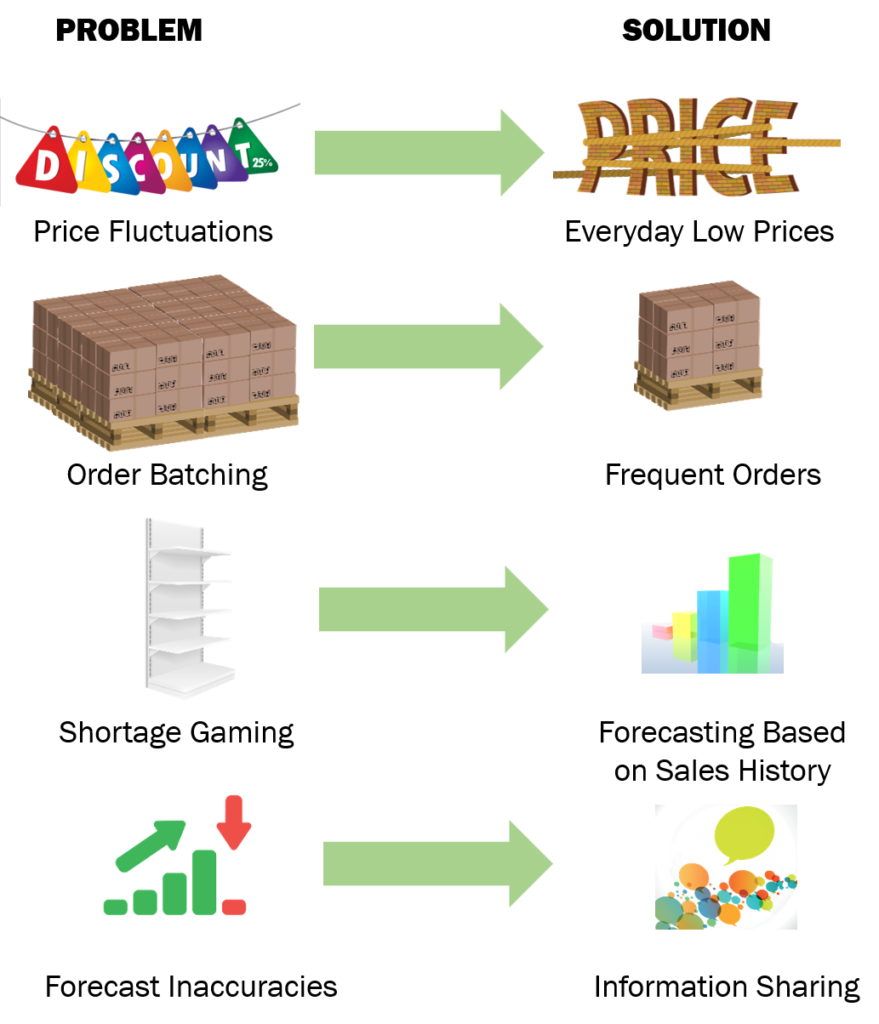

Both the video and the description provided by Shank and his colleagues make it very clear that the bullwhip effect is bad for all stakeholders. The video indicates there are four primary causes of the bullwhip effect and, as shown in the following graphic, it suggests a way to counter each cause.

Although those are excellent suggestions, the impression they leave is that countering the bullwhip effect is easy. It’s not.

Countering the Bullwhip Effect

Journalists Darian Woods (@DarianWoods) and Stacey Vanek Smith (@svaneksmith) write, “One question everyone wants to answer is how do we fix the broken supply chain?” They agree with the professors from the University of Tennessee that part of the solution is to counter the bullwhip effect. Of all of the suggested solutions mentioned above, the most important one is sharing information. To make that point, Woods and Smith note that the bullwhip effect has been studied for decades and part of those studies have included a beer game — the latest version of which was is a Beergame App created by logistics expert Mathias Le Scaon. Woods and Smith explain:

“Based on the Beer Distribution Game by the late MIT professor Jay Forrester, The Beergame App allows players to role-play as a retailer, wholesaler, distributor or brewer. While each person plays an equally important role in making sure the beer gets to customers, miscommunication between players often turns the game into a screaming match as supply-chain issues steadily increase the further the beer moves from the customer. Enter: The bullwhip effect.”

In a discussion about the bullwhip effect with NPR’s Kai Ryssdal (@kairyssdal), Harvard Business School professor Willy Shih (@WillyShih_atHBS), also discussed the beer game. He told Ryssdal, “In the 1960s, a group of researchers at the Massachusetts Institute of Technology developed an exercise to simulate supply chain dynamics using beer as an example. Versions of the ‘beer game’ or ‘beer distribution game’ are commonly used to teach supply chain principles and demonstrate the bullwhip effect.”[3] Ryssdal notes, “Shih plays a version of the game with his students and he said they invariably run into trouble ‘because everybody wants to outsmart everybody’ else.” When Ryssdal asked Shih why people should care about the bullwhip effect, Shih responded, “One of the lessons of the game is that players trying to ‘outsmart’ each other can have disastrous consequences for the supply chain.”

The way to avoid screaming matches (and disastrous consequences), created either by miscommunication or running into trouble by trying to outsmart others, is to share more information. As Shih explained to Ryssdal, “The answer is really for everybody in the chain to share information. If everybody can work together, then you can really optimize it.” Again, this solution sounds easy so why isn’t it happening? There is no single answer. People fail to share information for a lot of reasons. Jake Rheude (@JakeRheude), Vice President of Marketing at Red Stag Fulfillment, believes blockchain may provide one way to improve information sharing and dampen the bullwhip effect. He suggests, “There are three main issues that blockchain adoption can solve: [1] A single, unified source of data — instead of multiple data silos; [2] flexible, collateralized assets — instead of capital underutilization; and [3] instantaneous, real-time allocation of resources — instead of [being] reactive.”[4]

Rheude is not the first expert to suggest blockchain as a remedy for the bullwhip effect. Back in 2018, academics Sélinde van Engelenburg, Marijn Janssen, and Bram Klievink observed, “Supply chain management is hampered by a lack of information sharing among partners. Information is not shared as organizations in the supply chain do not have direct contact and/or do not want to share competitive and privacy sensitive information. … Private blockchains can be used to support parties in making their demand data directly available to all other parties in their supply chain. These parties can use this data to improve their planning and reduce the bullwhip effect.”[5]

Jan Keil (@JanKeil4), Vice President of Marketing at Infopulse, believes cloud computing is another essential technology that can be leveraged to reduce the bullwhip effect. He explains, “Cloud computing is an enabler for businesses to deploy new solutions for optimizing infrastructure, platform and software services delivery for the whole supply chain network via the Internet. Using cloud computing more links within your supply chain can be digitized — supplied with real-time data, better connectivity and improved data sharing tools for all supply chain participants. It’s the first necessary step to improve supply chain visibility and velocity.”[6] Keil also believes blockchain can play an essential role. He explains:

“Cloud computing is not the only strong technological candidate for improving information exchanges and collaboration within the supply chain. Blockchain can be used to tackle information asymmetry on a wider scale. As a secure digital ledger, the blockchain component can act as a single, unified source of data and enable real-time access to all the records, as well as seamless and automated updates. Several studies have proved that the bullwhip effect can be reduced when additional information is being shared with all parties such as: Inventory levels; work in progress levels; order data; [and] demand data. When these insights are available, all entities can base their forecasts on the same data, thus reducing those swings in production further down the supply chain.”

Monica Rose, an Assistant Professor at Amity University, concludes, “[The] bullwhip effect can be prevented if the data related to major supply chain activities such as inventory levels, work in progress levels, order data and demand data are available to all the entities in real time.”[7] She adds, “However, getting such a centralized system is a challenge and sharing data to all entities is [often] not feasible. In fact data sharing with everyone in the process is not always suggested due to different roles and hierarchy of people involved for whom all kinds of sensitive information could not be shared.” Like other experts cited above, she believes, “Blockchain addresses all these challenges. The data is available to all users by centralized access in a seamless manner to enable efficient decision making. In addition, the data shared can be done in dual manner where the public data is shared and data of private nature can be hidden. Hence the visibility is enhanced of both downstream and upstream activities in the supply chain. Blockchain, hence forth, minimizes to a great extent, even though not completely eradicate, issues related to execution, traceability, and coordination in [the] supply chain.”

Is blockchain a silver bullet that can be fired at the bullwhip effect? The simple answer is no. Blockchain still has some growing pains; however, knowing what information needs to be shared between stakeholders helps developers understand how to create a viable solution. The current supply chain mess should be all the incentive supply chain stakeholders need to encourage progress.

Footnotes

[1] Ted Stank, Tom Goldsby, and Lance Saunders, “Commentary: Caution—Bullwhip Effect Ahead,” The Wall Street Journal, 14 June 2021.

[2] Darian Woods and Stacey Vanek Smith, “Keep calm, it’s just the bullwhip effect,” NPR, 20 October 2021.

[3] Kai Ryssdal, “What the ‘beer game’ can teach about supply chain challenges,” NPR Marketplace, 29 June 2021.

[4] Jake Rheude, “Blockchain Technology is the Antidote to the Bullwhip Effect!” Supply Chain Game Changer, 5 November 2021.

[5] Sélinde van Engelenburg, Marijn Janssen, and Bram Klievink, “A Blockchain Architecture for Reducing the Bullwhip Effect,” In Shishkov B. (editor), Business Modeling and Software Design, Lecture Notes in Business Information Processing, volume 319, June 2018.

[6] Jan Keil, “How Can Cloud Computing and Blockchain Reduce the Bullwhip Effect in Supply Chain?” Infopulse Blog, 15 June 2020.

[7] Monica Rose, “Can Blockchain Reduce the Bullwhip Effect in Supply Chain?” LinkedIn, 18 March 2021.