Although many people still place all African countries into the same basket, analysts at McKinsey & Company remind us that growth prospects “differ not only country by country but also sector by sector.” [“Africa’s path to growth: Sector by sector,” McKinsey Quarterly, June 2010]. They indicate that overall the future for African states looks “bright”; that’s something you hear every day. They report:

“Africa’s 50-plus economies are growing at a remarkable pace: across the region, real GDP increased by an average of 4.9 percent a year between 2000 and 2008, compared with just 2.4 percent a year during the 1990s. Moreover, a number of African governments have undertaken structural reforms in recent years that are making their economies more attractive to investors. Indeed, the annual flow of foreign direct investment (FDI) into Africa in 2008 increased to $62 billion, from $9 billion in 2000. Relative to GDP, that is almost as large as the flow into China. This increased FDI accounted for the bulk of new African capital inflows, which grew rapidly from 2000 to 2008. Nonetheless, quickening economic growth cannot obscure the continent’s significant problems—among them, high levels of poverty, political instability, poor education, excessive government bureaucracy, and corruption. In addition, Africans must improve both the quality and accessibility of health care and address the sustainability of resources.”

To back their claim, McKinsey analysts look at seven economic sectors (agriculture, banking, consumer goods, infrastructure, mining, oil and gas, and telecommunications) and provide analysis on how they think African nations will do in that area. They also provide an excellent interactive map of Africa that provides an overview of Africa’s geography, population, literacy, major cities, mineral resources, and business climate. One other fact that they note to highlight progress being made on the African continent is that “as many as 200 million Africans will enter the consumer goods market by 2015.” They begin their tour d’horizon of the continent with a look at agriculture [“Agriculture: Abundant opportunities,” by Kartik Jayaram, Jens Riese, and Sunil Sanghvi]. Jayaram, Riese, and Sanghvi report:

“Agriculture is Africa’s largest economic sector, representing 15 percent of the continent’s total GDP, or more than $100 billion annually. It is highly concentrated, with Egypt and Nigeria alone accounting for one-third of total agricultural output and the top ten countries generating 75 percent. Africa’s agro-ecological potential is massively larger than its current output, however—and so are its food requirements. While more than one-quarter of the world’s arable land lies in this continent, it generates only 10 percent of global agricultural output. So there is huge potential for growth in a sector now expanding only moderately, at a rate of 2 to 5 percent a year. Four main challenges inhibit the faster growth of agricultural output in Africa.”

To achieve the agricultural potential noted in their analysis, Jayaram, Riese, and Sanghvi indicate that African states will have to overcome several challenges, including : fragmentation, a lack of interdependence, complexity, underinvestment and lack of infrastructure. They continue:

“Fragmentation. With 85 percent of Africa’s farms occupying less than two hectares, production is highly fragmented. In Brazil, Germany, and the United States, for example, only 11 percent or less of farms operate on this scale. Therefore, new industry models that allow small farms to gain some of the benefits of scale are required.

“Interdependence and complexity. A successful agricultural system requires reliable access to financing, as well as high-quality seeds, fertilizer, and water. Other essentials include access to robust markets that could absorb the higher level of agricultural output, a solid postharvest value chain for the output of farmers, and programs to train them in best practices so that they can raise productivity. Africa has diverse agro-ecological conditions, so countries need to adopt many different farming models to create an African green revolution.

“Underinvestment. To make the agricultural system work better, experts estimate, sub-Saharan Africa alone requires additional annual investments of as much as $50 billion. African agriculture therefore needs business models that can significantly increase the level of investment from the private and public sectors, as well as donors.

“Enabling conditions. A successful agricultural transformation requires some basics to be in place—transportation and other kinds of infrastructure, stable business and economic conditions, and trained business and scientific talent. Many African countries are making great strides in laying the groundwork, but others are lagging behind.”

Although African states badly need outside investment in the agricultural sector, not all approaches have received wholehearted support. One approach that has been particularly charged with emotion has been wealthy, but arid, countries purchasing African farmland in order to raise crops for shipment back home. For more on this subject, read my post entitled An Update on Buying the Farm. The next sector examined by McKinsey analysts is finance [“Banking: Building on success,” by Hilary De Grandis and Gary Pinshaw]. De Grandis and Pinshaw write:

“Africa’s banking sector has grown rapidly in the last decade. Sub-Saharan Africa has become a substantial player in emerging-market banking, with total 2008 assets of $669 billion, while North Africa’s asset base has grown substantially, to $497 billion. Africa’s banking assets thus compare favorably with those in other emerging markets, such as Russia (with $995 billion). Almost 50 percent of the growth at Africa’s largest banks came from portfolio momentum—the market’s natural increase—compared with only about 17 percent from inorganic (or M&A-driven) sources. Underpinning this portfolio momentum is strong overall market expansion: the financial sector is outgrowing GDP in most of the continent’s main markets. Between 2000 and 2008, for example, Kenya’s GDP grew by 4.4 percent annually, its financial sector by 8.5 percent. The only significant exception is Egypt, where regulatory restrictions have limited the sector’s growth to only 2.3 percent annually, compared with 4.8 percent for GDP. Financial reforms have largely enabled this growth.”

Finance is a tricky area; especially in regions where corruption is rife. De Grandis and Pinshaw report, however, that progress is being made. In Nigeria, for example, the “central-bank governor [who was appointed in August 2009] initiated reforms to increase accountability and transparency.” They conclude:

“Although lower growth is expected in the African banking sector in the next few years, attractive opportunities remain—expanding current product offerings, increasing product penetration, bringing the unbanked into the financial system, and capitalizing on the rise of a new consumer class by developing innovative service and channel offerings. Banks have employed several strategies to capture this growth.”

One of the biggest boons to the financial sector in Africa has been the use of mobile phone technology to transfer funds. To read more on this topic, see my posts entitled Mobile Phones in Africa and Mobile Phones and Development. The next sector examined is consumer goods [“Consumer goods: Two hundred million new customers,” by Reinaldo Fiorini and Bill Russo]. Fiorini and Russo report:

“Resources are not Africa’s only driver of growth. Underlying it, the African consumer is on the rise. From 2005 to 2008, consumer spending across the continent increased at a compound annual rate of 16 percent, more than twice the GDP growth rate. GDP per capita rose in all but two countries. Many consumers have moved from the destitute level of income (less than $1,000 a year) to the basic-needs ($1,000 to $5,000) or middle-income (up to $25,000) levels. In Nigeria, for example, the collective buying power of households earning $1,000 to $5,000 a year doubled from 2000 to 2007, reaching $20 billion. Nearly seven million additional households have enough discretionary income to take their place as consumers. This evolution is critically important to consumer-facing businesses, from fast-moving consumer goods manufacturers to banks to telecommunications companies: when people begin earning money at the basic-needs level, they start buying and consuming goods and services. Additionally, we have observed that most consumer categories exhibit an S-curve growth pattern: in other words, when a country achieves a basic level of income, growth rates accelerate three- to fourfold. While the exact inflection point differs among categories, many of them are just entering this phase of accelerated growth. The enormous expansion of mobile telephony in Africa provides clear evidence of this phenomenon.”

Frankly, it was not too many years ago when people looked on Africa as a sinkhole down which money was being poured with no returns or improvements expected. As a result, nobody was interested in doing business with the majority of countries there. Although economic conditions remain grim in many parts of Africa, renewed interest in African resources and an emerging middle class has meant that Africa is no longer the world’s economic orphan. People are taking notice. Fiorini and Russo conclude:

“Despite the recent slowdown in economic expansion, GDP per capita should continue on its positive trajectory of a 4.5 percent compound annual growth rate (CAGR) until 2015. That would mean a more than 35 percent increase in spending power. Combined with strong population growth (2 percent) and continued urbanization (3 percent), this increase leads us to estimate that 221 million basic-needs consumers will enter the market by 2015. As a result, the number of attractive or highly attractive national markets—with more than ten million consumers and gross national income exceeding $10 billion a year—will increase to 26 in 2014, from 19 in 2008.”

Commenting on the McKinsey report, Fiona Rintoul summed it up by writing, “Global attention turns to the continent, but it is still not an easy market.” [“Vibrant Africa beckons investors as outside perceptions begin to change,” Financial Times, 2 August 2010]. The fact that perceptions about Africa are beginning to change is nevertheless a positive sign. Rintoul concludes her report with both optimism and caution:

“As infrastructure improves, so economic growth will expand. ‘If countries can achieve 6 per cent annual GDP growth without infrastructure, think what they will be able to achieve with it!’ enthuses Ms Akinluyi. That, at least, is the theory, and there are plenty of numbers to underpin optimism. Africa’s demographic profile is stellar – by 2050 it will be home to one-third of the world’s under-25s. There are more middle-class families in Africa than in India and they are under-penetrated in every conceivable area: telecommunications, consumer goods, financial services. At the same time, there are some African countries that give little cause for optimism. The hope there is that the growing trend for people to ‘demand more from their governments’ identified by Ms Akinluyi will spread throughout the continent. But however bullish you are on Africa, the fact remains it is not easy to invest there. Capital markets are shallow, many stocks are illiquid, information is scarce and the continent is just about as diverse as it is possible to be. Deep local knowledge at the micro level is essential, and if you do not have that, there is, says Mr Derksen, a very good case for investing in companies with a high exposure to Africa that are listed abroad. Otherwise, many of the best opportunities lie on the private equity side. But even then, deal flow is not yet strong enough, says Mr Vovor, and government incentives are needed to accelerate the project pipeline. Enthusiasm for Africa may be growing; finding an outlet for that enthusiasm can be a problem at the moment. However, with capital markets expanding, many diaspora executives returning to Africa to work, and intra-Africa trade on the rise, this is likely to change over the next five years.”

The final sector analyzed by McKinsey analysts that I will address in this post is infrastructure [“Infrastructure: A long road ahead,” by Rod Cloete, Felix Faulhaber, and Markus Zils]. As the headline from the report implies, they are not as optimistic in this sector as analysts have been in others. Cloete, Faulhaber, and Zils write:

“Between 1998 and 2007, spending on African infrastructure rose at a compound annual rate of 17 percent—up from $3 billion in 1998 to $12 billion in 2008, significantly outstripping the growth of global infrastructure investment. Africa accounted for 11 percent of total global private-sector and foreign-funded investment from 1999 to 2001 and for 17 percent from 2005 to 2007. This growth has been driven largely by increased funding from non-OECD governments—particularly China’s, which provided 77 percent of it in 2007. The private sector is still the largest single source of funds (45 percent in 2007). Rapid growth has attracted many multinational companies within and outside Africa. While this growth has been substantial, the size of the investment gap that must be closed if the continent is to realize the United Nations’ Millennium Development Goals is more than $180 billion for sub-Saharan Africa alone (2007–14). Governments and the private sector must therefore substantially increase their infrastructure spending.”

Although China has been the major player investing in African infrastructure, African states are learning that such investment comes with a price. For more on that subject, read my post entitled China in Africa: The Ups and the Downs. Cloete, Faulhaber, and Zils continue:

“For Nigeria, which aims to be among the world’s top 20 economies by 2020, reaching the same infrastructure levels that Brazil has today would require investments in excess of $190 billion—60 percent of today’s GDP—or an additional 3 percent of GDP for the next 20 years. So the growth trend in African infrastructure is far from over, and several countries have already announced significant additional spending. South Africa, for example, will invest $44 billion in transport, fuel, water, and energy infrastructure from 2009 to 2011—a 73 percent increase in annual spending from the levels of 2007 to 2008. Since infrastructure investments also offer a high stimulus multiple in times of economic slowdown, Angola, Kenya, Mozambique, Nigeria, and Senegal have announced essentially similar programs, though on a much smaller scale. Examined at a more granular level, this remarkable growth has clearly occurred in a limited set of countries and sectors. Algeria, Kenya, Morocco, Nigeria, South Africa, and Tunisia were responsible for 75 percent of the investment from 1997 to 2007. Infrastructure spending, fueled by an oil boom, is also growing rapidly in Angola.”

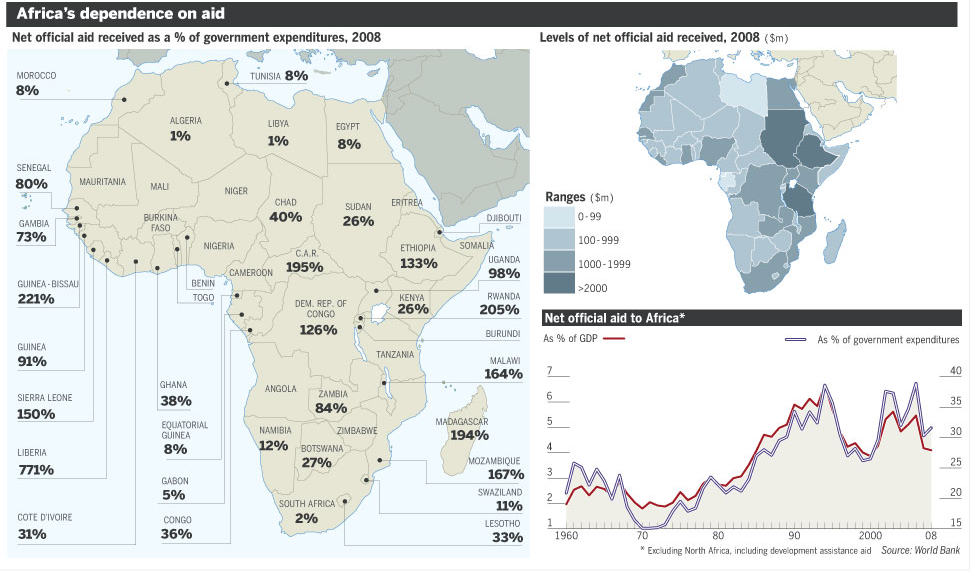

What you might have noticed is that Cloete, Faulhaber, and Zils fail to mention the majority of African nations that simply lack any resources to update their infrastructure. They represent the very bottom of the economic pyramid and will likely linger in that position for decades to come. As a result, they will remain wards of the international community and reliant on the charity of other states to remain afloat. The following chart shows what I mean.

My colleague Tom Barnett wrote this about the above chart in his blog:

“Experience says once a country gets above approximately 15% of the GDP in aid, they’re in trouble (it’s a diversionary effect that also allows the government to care less what its public thinks). … What stands out:

1) the single-digit crowd of North Africa and the southern cone (Morocco, Algeria, Tunisia, Libya, Egypt, South Africa) and the outlier of Equatorial Guinea; and

2) the 100-plus-% crowd of Guinea-Bissau, Sierra Leone, Liberia, C.A.R., Congo, Mozambique, Malawi, Rwanda, Ethiopia and Uganda (98%).”

Tomorrow I will examine the remaining sectors analyzed in the McKinsey report: mining, oil and gas, and telecommunications.